Making A Difference Foundation is in partnership with the WA Department of Commerce and WA Department of Revenue to perform community outreach, education, and awareness around Washington State’s new Working Families Tax Credit (WFTC) and the Federal Earned Income Tax Credit (EITC). These programs repay a percentage of the sales tax paid by low-income families by offering a cash refund. These tax refund opportunities will allow residents of Washington who qualify to receive a substantial tax refund over previous years and will make a difference in the lives of our clients.

FOR MORE INFORMATION, PLEASE JOIN US ON A BRIEF ZOOM CALL.

SEE DETAILS BELOW.

ZOOM INFO: MADF to discuss Working Families Tax Credit (WFTC)

TIMEFRAME: Feb. – June 2024

- Wednesdays: 12:00pm – 12:30pm

- Wednesdays: 7:00pm – 7:30pm

- Saturdays: 12:00pm – 12:30pm

Meeting ID: 253 212 2778; Passcode: 1234

TAX DATES TO REMEMBER

1/24/2024 – IRS starts to process Tax Returns for 2023 tax year.

2/21/2024 – “VITA” programs open their doors with Free Taxes services.

4/15/2024 – If you did not file an extension, Tax Returns are due for 2023 Tax Year.

Did you know that you are probably eligible for the WFTC and EITC?

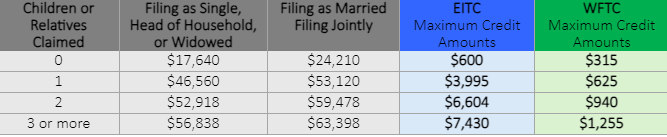

The Working Families Tax Credit (WFTC) will provide payments up to $1,255 and the Earned Income Tax Credit (EITC) will provide payments up to $7,430 for tax year 2023 to individuals and families who meet the requirements.

The MADF Tax Preparer season ends on May 15, 2024 because all appointment slots have been scheduled.

If you qualify, the next step is to meet with a FREE TAX PREPARER to ensure you get your maximum refund.

Go to www.irs.gov/eitc to learn more! You can also go here: Home | Washington State Working Families Tax Credit

Have Questions?

Contact our Tax Credit Awareness Program Team

at tax@themadfseattle.org.

253-212-2778

Report Phishing and Online Scams:

Report Phishing | Internal Revenue Service (irs.gov)